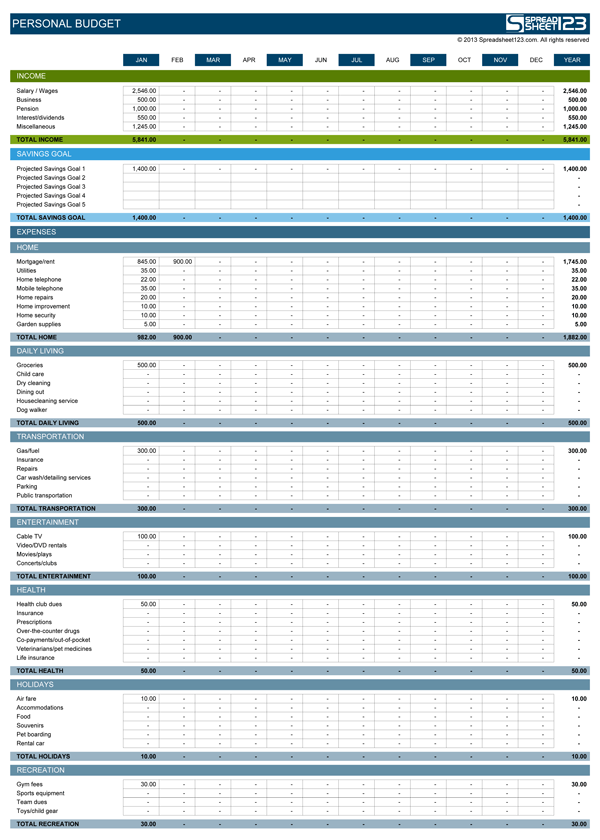

Another 30% can go toward the things you want, like traveling, dining out, or buying things that aren't strictly necessary. Then, you split it up so 50% goes towards your basic needs, like your rent or mortgage, utilities, food, and clothing. In the 50-30-20 method, you start by figuring out your income. Try the 50-30-20 method for an easy way to divide up your spending. X Expert Source Trent Larsen, CFP®Ĭertified Financial Planner Expert Interview. You don't necessarily have to save that all at once, but over time, if you save into it, you'll be able to cover your expenses if you lose your job or run into another emergency. It's recommended that you have 3-6 months' worth of expenses in your emergency savings.For instance, you might open a savings account with your bank, or if you prefer to keep your cash in savings, you might keep it in an envelope that's locked in a safe. Keep your savings somewhere separate from your spending money.For instance, you might start by saving $20 out of every paycheck, or you might set a goal of saving $500 by the end of the year. Ideally, you should eventually have about 3-6 months' worth of expenses saved, but it's okay if you need to set a smaller goal at first.It can help to have this money automatically deducted and moved into a savings account, since you'll be less likely to miss the money if you never see it.

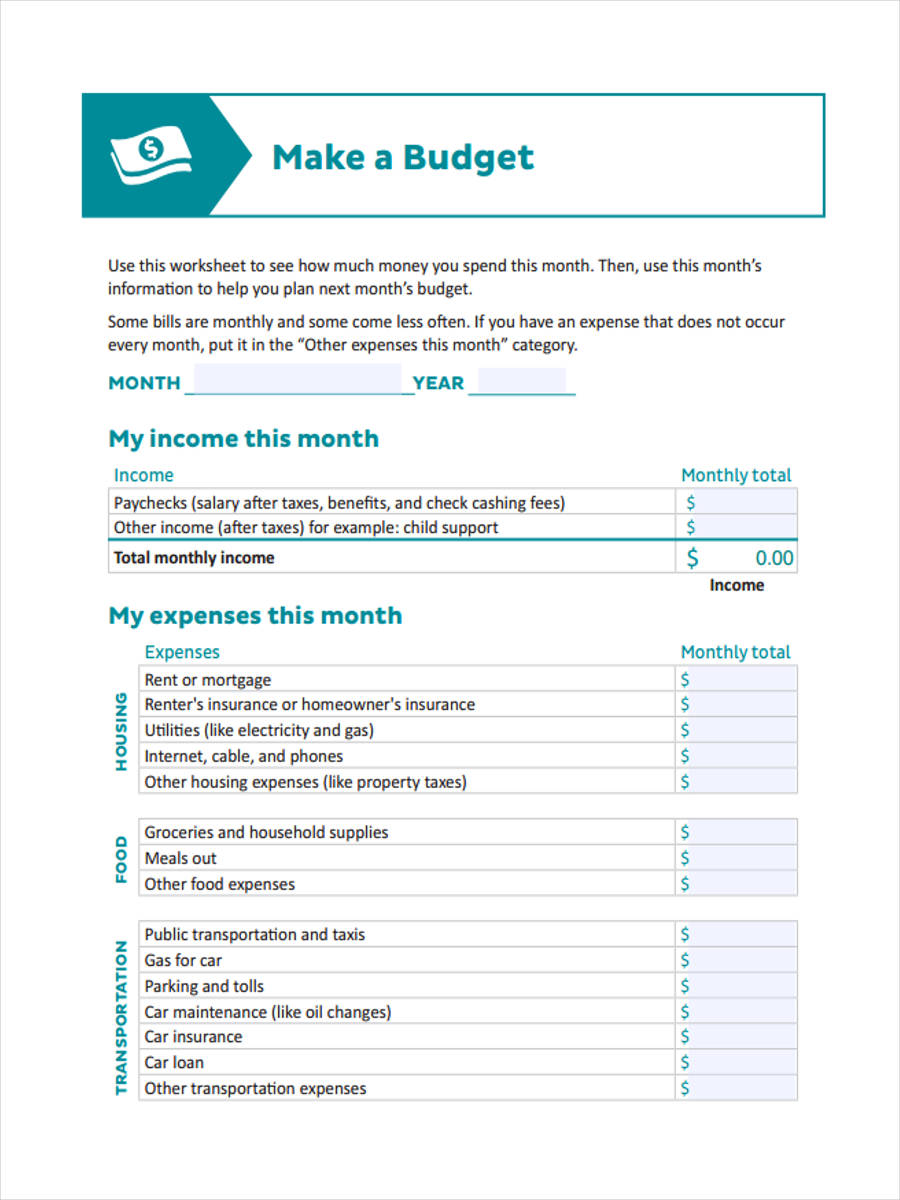

As you plan out your budget, be sure to include a little money out of each paycheck to grow your savings. Part of being financially healthy involves having savings set aside for things like emergencies and large expenses. Put some of your extra money into savings each month. However, if you regularly find yourself running out of money in a certain category, you may need to add more money to that envelope at the beginning of the next month. Don't borrow from one envelope if you overspend from another-otherwise, you may find yourself running short at the end of the month.If you pay your bills online, you can still use the envelope method for controlling your spending money.For instance, you might put $100 a week into an envelope labeled "Groceries" and $20 into one labeled "Gas." Then, you'd take the "Groceries" envelope with you when you're buying food and the "Gas" envelope when it's time to fill up your vehicle.That way, you'll know exactly how much you're spending, and it will be easier to stay on budget. Then, only use the money from each envelope for its intended purpose. Put the money you've budgeted for each category into its corresponding envelope. The envelope budgeting system involves splitting your money between different envelopes, each with a designated spending category. Divide your money into envelopes to help keep cash payments organized.

0 kommentar(er)

0 kommentar(er)